Business Plan 2022

The Group strategy aims to further increase the desirability of the BOSS and HUGO brands. At the same time, HUGO BOSS aims at creating long-term value for shareholders. All entrepreneurial decisions made by the management have the goal of securing sustainable growth of sales and EBIT and ultimately increasing free cash flow. In this context, in November 2018 HUGO BOSS presented its mid-term targets until 2022 as part of its investor day.

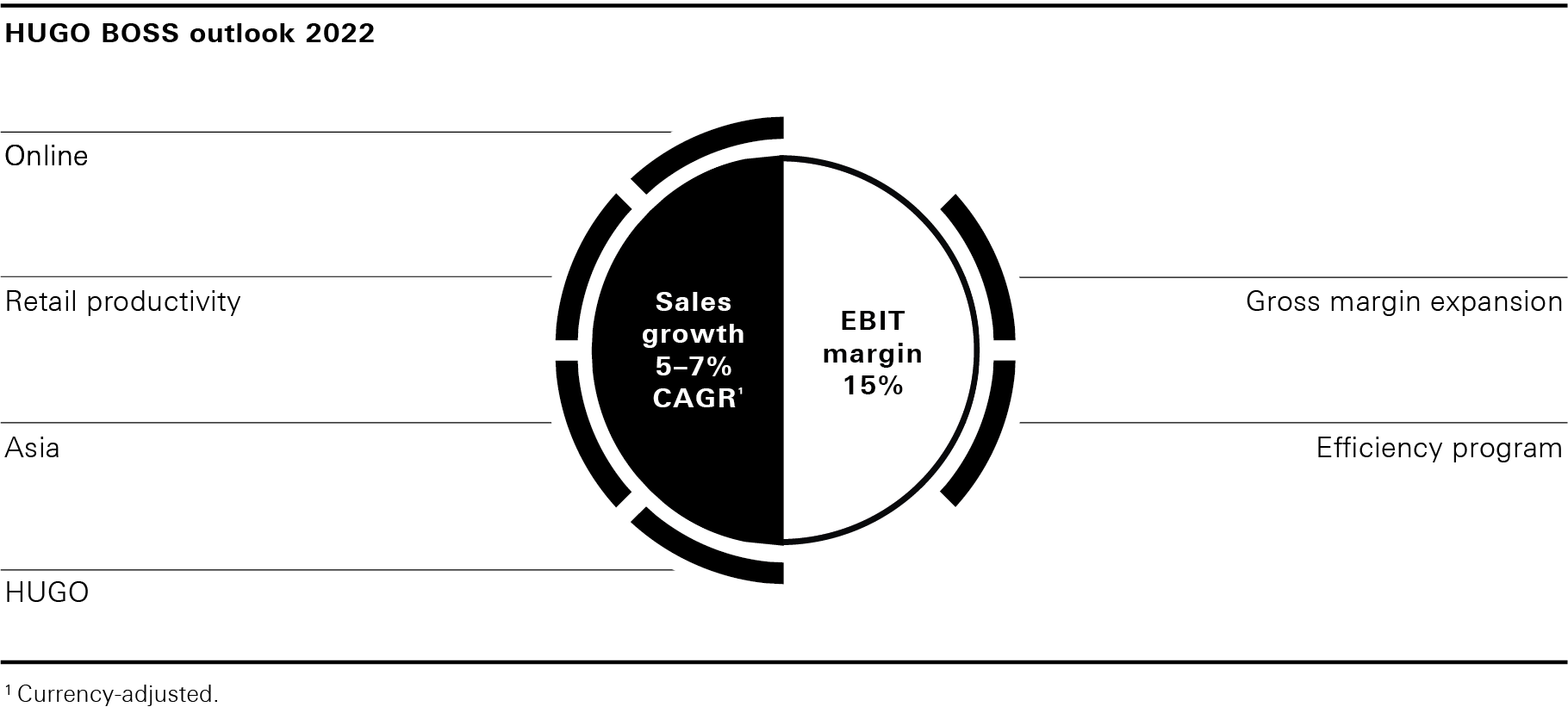

The Company anticipates to increase Group sales on a currency-adjusted basis by an average of 5% to 7% per year until 2022. Sales are therefore expected to outgrow the projected growth of the relevant market segment for HUGO BOSS in the coming years. Four factors are particularly crucial for future growth: significant growth in the Group’s own online business, an improvement in retail sales productivity, exploiting the growth potential in Asia, and above-average growth of HUGO in the contemporary fashion segment.

The Company sees great growth opportunities in expanding its online business. With overproportionate growth rates, this sales channel is expected to contribute to the company objectives in the coming years, in particular by expanding the concession model and fully utilizing the potential in the Group’s own online store, hugoboss.com. The Group plans to quadruple its sales in its own online business by 2022. Group Strategy, Further Refinement of the Distribution Strategy

HUGO BOSS aims to increase retail sales productivity by an average of 4% annually until 2022. Along with an optimization of the store network, accelerated modernization of existing BOSS stores, expansion of omnichannel services and improvements in product ranges and services are expected to contribute to this. Group Strategy, Further Refinement of the Distribution Strategy

The Managing Board sees considerable growth potential particularly in Asia. Sales in the region are expected to increase at a double-digit percentage rate on average per year until 2022, with China playing a key role. The share of sales from Asia will thus increase from its current 15% to around 20% by 2022. In addition to the optimization and expansion of the local retail network, the online business supported by various multibrand platforms, should contribute to overproportionate sales growth.

The Company also sees great potential for the HUGO brand. In the coming years, the focus on the dynamic contemporary fashion segment should contribute to overproportionate growth and therefore also to achieving company targets. This entails taking full advantage of the potential of the HUGO brand in the casualwear segment. Furthermore, additional HUGO stores with a unique store concept will be opened, and the HUGO brand will increase its social media activity. Group Strategy, HUGO Brand Strategy

The Company has set itself the target to grow operating profit (EBIT) significantly faster than sales by 2022. In doing so, the EBIT margin shall increase to 15% by 2022 (2018: 12.4%). An improved gross profit margin and a Group-wide efficiency program with a strong focus on a more efficient use of operational expenses will contribute to this development.

To improve the gross profit margin, particular emphasis in the coming years will be placed on further increasing the sales share from the Group’s own retail business, reducing the complexity of the BOSS and HUGO collections, improving markdown management, and decreasing the sales share of the outlet business. The efficiency program aims at improving the profitability of the Group’s own retail business, using marketing expenditures more effectively, and optimizing the organizational structure. Additional investments in digitizing the business model will partly offset the savings achieved. Earnings Development

The Managing Board expects to generate free cash flow of between EUR 250 million and EUR 350 million per year in the coming years. Not only above-average earnings growth but improvements in trade net working capital and efficiencies in the investment budget will also contribute to this. The free cash flow generated by the Group will primarily be used to fund the dividend distribution. Taking into account the Group's very healthy financial position and the anticipated strong free cash flows, HUGO BOSS has set a goal of regularly distributing between 60% and 80% of the Group’s net income to its shareholders. Financial Position, Statement of Cash Flows

HUGO BOSS has decided not to take into account the impact of IFRS 16 in formulating its mid-term targets by 2022. This is intended to allow for better comparability of the Group’s current financial, asset and earnings position with the mid-term targets. A full description of the expected impact of IFRS 16 can be found in the Notes to the Consolidated Financial Statements. Notes to the Consolidated Financial Statements, Financial Reporting

The targets for fiscal year 2019 are presented in the Outlook section. Outlook