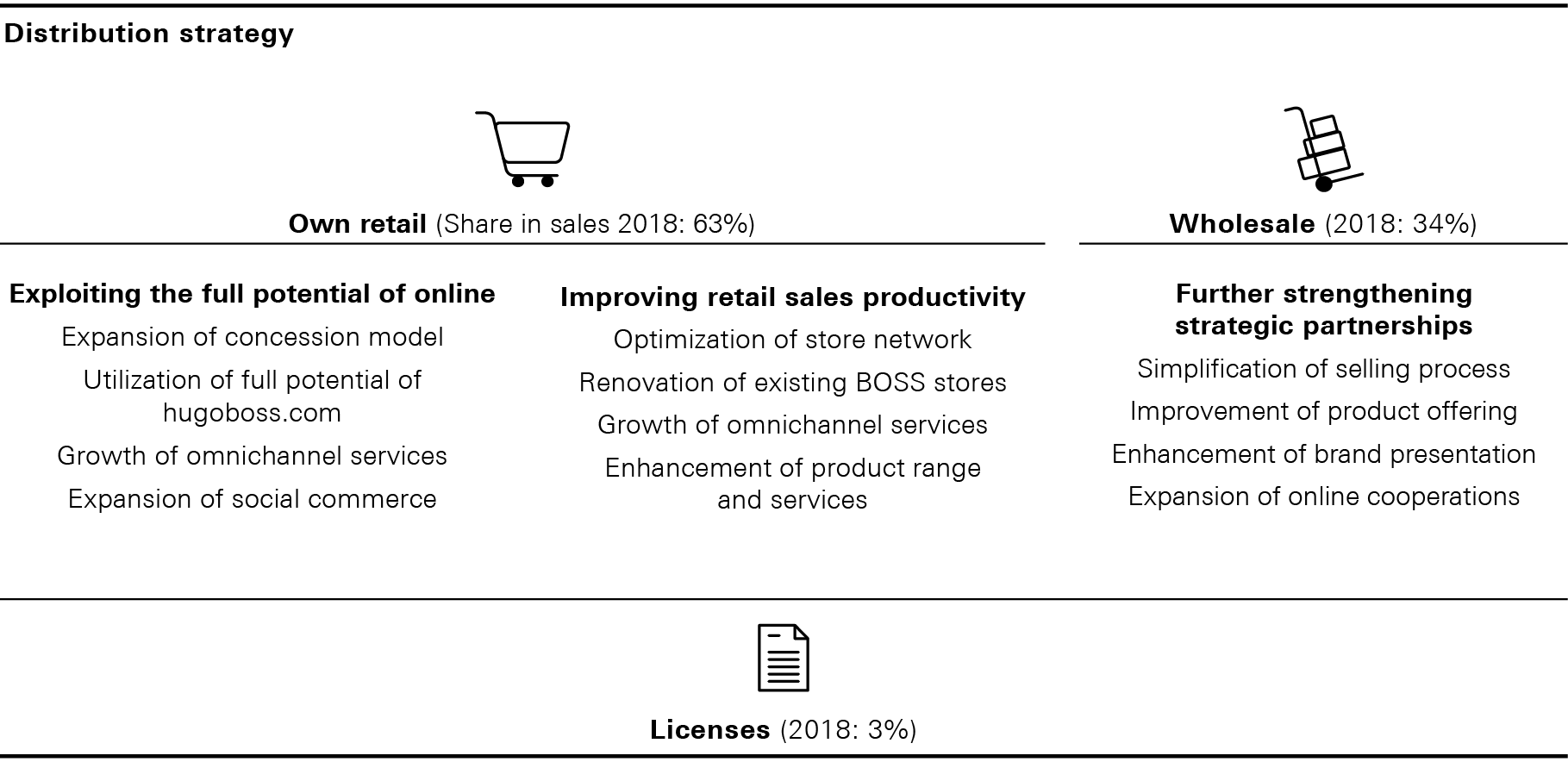

Further refinement of the distribution strategy

HUGO BOSS is systematically aligning its distribution to cater to BOSS and HUGO customer buying preferences. Both brands are distributed via the Group’s own retail and wholesale businesses, both online and via brick-and-mortar retail. For this, the Group attaches particular importance to a globally consistent brand image. Against this backdrop, retail prices have been largely harmonized in the various regions over the last few years.

Exploiting the full potential of online

The Company sees great growth opportunities above all in expanding its own online business. The Group plans to quadruple its sales in this distribution channel by 2022. The expansion of the concession model in the online business and the full utilization of the potential in the Company's own online store, hugoboss.com, should contribute decisively to this.

HUGO BOSS is selectively seeking closer collaborations with those multibrand platforms whose presentation best matches the brand values of BOSS and HUGO. A significant measure in this is the expansion of the concession model to the online area. The Company already introduced this business model into its business years ago with brick-and-mortar retailers in which HUGO BOSS sells to customers on its own behalf and on its own account. This enables HUGO BOSS to directly manage the presentation and distribution of its brands in a third party retail environment. In this context, HUGO BOSS in 2018 has intensified its partnership with well-known online provider Zalando and expanded the product range of the BOSS brand. The Company is thus in a position to better serve its customers. In coming years, the Asia/Pacific and Europe regions will be the focus areas for expanding the concession model via online cooperations.

Moreover, HUGO BOSS intends to fully utilize the potential of its online store hugoboss.com and develop it into a digital flagship store. To do so, the Company is continuously optimizing the user-friendliness of its website, which as of today is already present in eleven important markets. Above all, in 2018 the creation of two separate brand worlds for BOSS and HUGO and further improvements in the page structure, the website and mobile app navigation and the integration of additional services like the “Online Fit Finder” or the “Online Stylist” will lead to a marked improvement in user-friendliness. For 2019, the Company plans in particular to further expand personalized online offerings. In future, the expansion of hugoboss.com to online markets not yet accessed by the Company will also contribute to sales growth. The Company also sees potential in the increasingly commercial use of digital channels previously used purely for communication purposes, such as Instagram, for example.

Improving retail sales productivity

Improving retail sales productivity in its own physical retail business is currently another major lever available to HUGO BOSS for growing its business. HUGO BOSS aims to increase its sales per square meter by an average of 4% per year until 2022. This will be supported not only by optimizing the store portfolio but, above all, by enhancing the shopping experience.

The Group sees an opportunity to expand the distribution of BOSS and HUGO through selective new store openings. Particularly in the Chinese market, the Group sees potential to open up more BOSS stores in the coming years. Following the openings of the first HUGO stores with their own store concept in 2018 in select European metropolitan areas like Amsterdam, London and Paris, the Company plans further openings in coming years for HUGO as well. At the same time, the Company will use expiring lease agreements to reduce the size of, relocate or ultimately close its own retail stores that are not meeting productivity and yield requirements. Consequently, HUGO BOSS anticipates that total selling space in its own retail stores to remain largely stable in the coming years. Earnings Development, Sales Performance

The Company sees the enhancement of the shopping experience as another key lever for increasing retail sales productivity. Besides further enhancing the product range, improving services will also play a major role. Thus, HUGO BOSS has widened its training opportunities for sales staff to additionally improve the quality of service. Consistent renovation of existing BOSS stores using the new store concept already implemented at select locations in 2018 also represents a major lever in upgrading the shopping experience. Particular importance is ultimately being attached to growing omnichannel services. Today, for example, customers can check whether a product offered in the online store is also available in the nearest brick-and-mortar BOSS store. In Europe and the United States, services like “Click & Collect” – in-store pick-up of items purchased online – or “Order from Store” – online ordering of missing sizes or items in the store – are also available.

Further strengthening of strategic partnerships in the wholesale channel

The wholesale business will remain an important distribution channel for HUGO BOSS in the future. Consequently, the Group intends to further strengthen its strategic partnerships in wholesale. In particular, by aligning its product range more closely to the needs of its partners, taking steps to upgrade its brand presentation at the point of sale, and expanding online cooperations, the Group sees growth opportunities in its wholesale business. Potential also exists in simplifying the selling process, particularly through greater use of digital showrooms. HUGO BOSS reserves the right to continue adjusting its wholesale distribution if the brand presentation and environment do not live up to the requirements of BOSS and HUGO. Finally, the Company expects the wholesale market to continue seeing a trend towards consolidations in bricks-and-mortar retail and closures of smaller, often owner-operated specialist stores.