Income statement

|

2018 |

In % of sales |

2017 |

In % of sales |

Change in % |

|||||||

|

||||||||||||

Sales |

2,796 |

100.0 |

2,733 |

100.0 |

2 |

|||||||

Cost of sales |

(972) |

(34.8) |

(925) |

(33.8) |

(5) |

|||||||

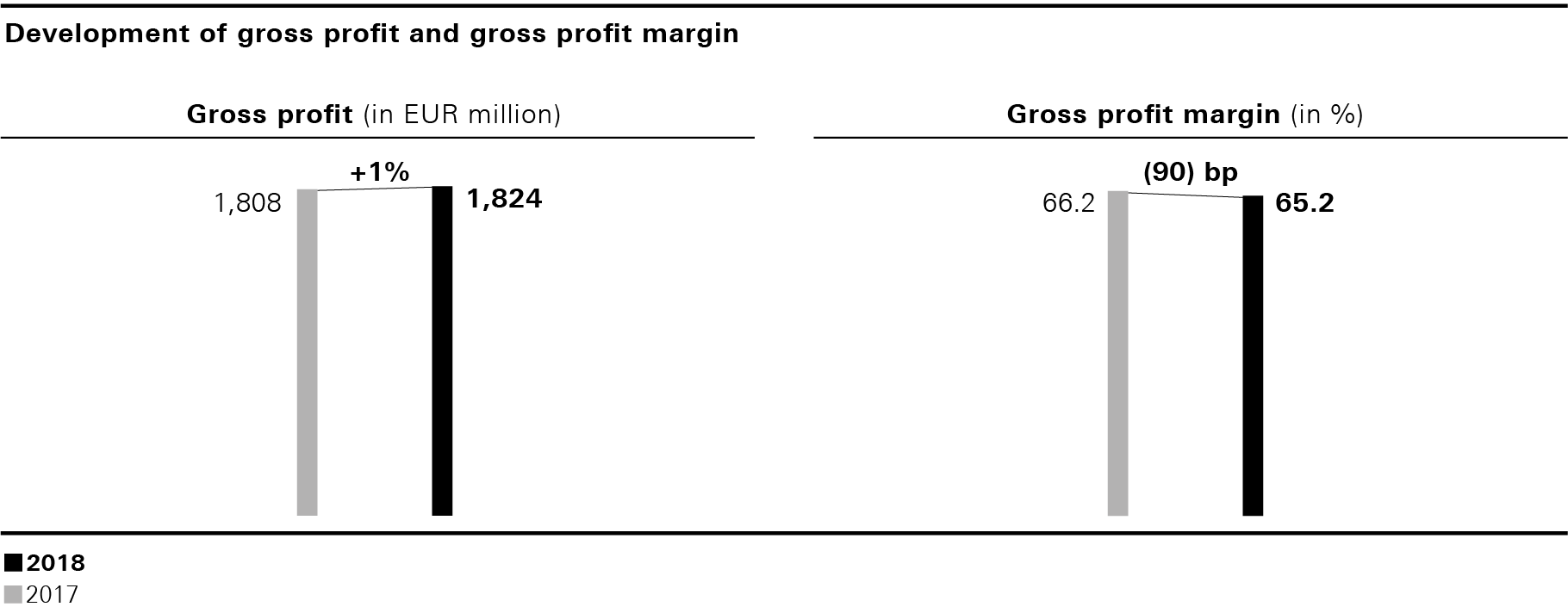

Gross profit |

1,824 |

65.2 |

1,808 |

66.2 |

1 |

|||||||

Selling and distribution expenses |

(1,174) |

(41.9) |

(1,195) |

(43.7) |

2 |

|||||||

Administration expenses |

(290) |

(10.4) |

(280) |

(10.3) |

(4) |

|||||||

Other operating income and expenses |

(13) |

(0.5) |

8 |

0.3 |

<(100) |

|||||||

Operating result (EBIT) |

347 |

12.4 |

341 |

12.5 |

2 |

|||||||

Financial result |

(10) |

(0.4) |

(10) |

(0.4) |

(4) |

|||||||

Earnings before taxes |

337 |

12.0 |

331 |

12.1 |

2 |

|||||||

Income taxes |

(101) |

(3.6) |

(100) |

(3.6) |

0 |

|||||||

Net income |

236 |

8.4 |

231 |

8.5 |

2 |

|||||||

Earnings per share (EUR)1 |

3.42 |

|

3.35 |

|

2 |

|||||||

EBITDA before special items |

489 |

17.5 |

491 |

18.0 |

0 |

|||||||

|

|

|

|

|

|

|||||||

Income tax rate in % |

30 |

|

30 |

|

|

|||||||

At 65.2%, the gross profit margin in fiscal year 2018 was 90 basis points below the prior year’s level (2017: 66.2%). The decline is mainly due to investments in the product quality. In addition, currency effects had a slightly negative impact on the gross margin development.

In fiscal year 2018, selling and distribution expenses were 2% below the prior year level. Relative to sales, they declined from 43.7% to 41.9%. A slowdown in retail expansion and positive effects from renegotiated rental contracts in the Group’s own retail business in particular led to a 2% decrease in selling expenses. At 32.6%, they accounted for a lower percentage of sales compared to the prior year’s level (2017: 34.0%). Marketing expenses decreased by 6% compared to the same period of the prior year. At 6.2%, they were also below the prior year level as a percentage of sales (2017: 6.8%). Logistics expenses, by contrast, rose by 6% over the prior year and, at 3.1% of sales, were slightly up on the prior year (2017: 3.0%). This was mainly due to the positive performance of the online business that led to higher personnel costs and other expenses. Notes to the Consolidated Financial Statements, Note 2

Consistent cost management limited the increase in administrative expenses in the past fiscal year. General administrative costs grew by 4%, mainly due to investments in the digital transformation of the business model. HUGO BOSS expects these investments to deliver an important stimulus to sales and to accelerate operational processes. At 8.1%, general administrative expenses as a percentage of sales were only slightly above the prior year level (2017: 8.0%). Research and development costs incurred during the collection development increased by 1% compared to the prior year. As a percentage of sales, however, research and development costs remained stable at 2.3% (2017: 2.3%). Notes to the Consolidated Financial Statements, Note 3

Net expenses arising from other operating expenses and income amounted to EUR 13 million in fiscal year 2018 (2017: net income of EUR 8 million). In the reporting period, expenses were incurred in connection with organizational changes. Furthermore, the item includes expenses that arose from the recognition of a provision for liabilities in the context of the former production site in Cleveland, Ohio, United States. Notes to the Consolidated Financial Statements, Note 4

|

2018 |

In % of sales |

2017 |

In % of sales |

Change in % |

|||||

Earnings before taxes |

337 |

12.0 |

331 |

12.1 |

2 |

|||||

Financial result |

(10) |

(0.4) |

(10) |

(0.4) |

(4) |

|||||

Operating result (EBIT) |

347 |

12.4 |

341 |

12.5 |

2 |

|||||

Depreciation and amortization |

(129) |

(4.6) |

(158) |

(5.8) |

18 |

|||||

EBITDA |

476 |

17.0 |

499 |

18.3 |

(5) |

|||||

EBITDA related special items |

(13) |

(0.5) |

8 |

0.3 |

<(100) |

|||||

EBITDA before special items |

489 |

17.5 |

491 |

18.0 |

0 |

EBITDA before special items recorded a stable development in the fiscal year. Positive effects resulting from the increase in sales and the consistent cost management were offset by investments in product quality and in the digital transformation of the business model. Currency effects had an overall negative impact on earnings development. This was mainly due to the currency devaluations outside the Eurozone. At 17.5%, the adjusted EBITDA margin was down 50 basis points on the prior year’s level (2017: 18.0%).

EBIT rose by 2%. The EBIT margin, on the other hand, recorded a slight decrease of 10 basis points to 12.4% (2017: 12.5%). Amortization and depreciation amounted to EUR 129 million, down 18% on the prior year’s period due to lower capital expenditure in the prior years and decreased impairments recognized on property, plant and equipment in own retail stores (2017: EUR 158 million).

The financial result as a net expense of the interest result and other financial items was at the prior year’s level. In fiscal year 2018, the Group tax rate remained stable at 30% (2017: 30%). Income tax expenditure increased during the reporting period as a result of costs related to the recognition of a provision for risks arising from a tax field audit at HUGO BOSS AG. On the other hand, expenses recognized in the prior year from the revaluation of deferred tax assets in connection with the U.S. tax reform did not recur. Notes to the Consolidated Financial Statements, Note 5 and 6

The Group’s net income consequently rose 2%.